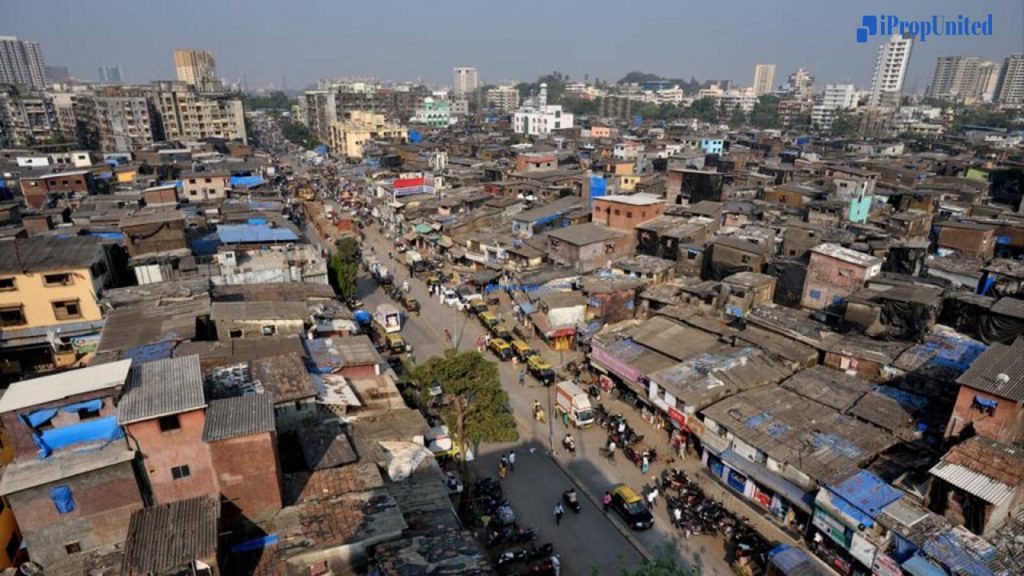

MUMBAI: Jayshree Sukhadia, a resident of Chira Bazaar, files a complaint with MahaRERA seeking justice after facing demands for additional payment and failure to refund Rs 13 lakh for a flat booked in 2017. The first hearing on Sukhadia’s case is delayed for a year, reflecting the backlog and delays faced by home buyers in Maharashtra.

Sukhadia’s complaint, filed in October 2020, finally receives its first hearing in October 2021, leading to its referral to the conciliation forum. However, the conciliation efforts fail in March 2022, leaving the case without a future hearing date.

The plight of Sukhadia is not unique, as many home buyers find themselves in a similar situation. Out of the 21,274 cases filed with MahaRERA to date, a staggering 6,989 cases are either pending or in the process of being heard. The delay in addressing these complaints has had a detrimental impact on home buyers, prompting some to seek redress through consumer courts instead of MahaRERA.

The authorities at MahaRERA attribute the prolonged hearing process and complaint resolution delays to the vacancies within the regulatory authority. Presently, only two members, including the chairman, are available to hear complaints, leading to a significant backlog. Despite protests and representations, the state government has failed to replace the members whose terms expired.

Anil Dsouza, secretary of the MahaRERA Bar Association, expressed concerns, stating, “In other courts, the next hearing date is typically scheduled within two to three months. However, in MahaRERA, obtaining the next hearing date itself takes over a year. Matters are often adjourned sine die, without providing a future date. How can the reduced number of benches manage the increasing number of complaints?”

He added, “Around 300 fresh complaints are filed with MahaRERA each month. However, the two existing benches can only dispose of a similar number of complaints monthly. For the past two years, MahaRERA has operated with only two members in addition to the adjudicating members. Although the government attempted to appoint additional members, the appointments did not materialize. Appointing just one member would resolve the problem and clear the backlog of complaints.”

A MahaRERA official commented, “Valsa Nair Singh, additional chief secretary, housing department, did not respond to this correspondent’s call and text message seeking comment.”

Advocate Godfrey Pimenta, representing the Watchdog foundation, highlighted the requirements of Section 21 of the Real Estate (Regulatory and Development) Act, 2016. Pimenta emphasized, “The authority should consist of a Chairperson and at least two full-time members appointed by the government. Currently, MahaRERA only has a chairperson and one member. The Adjudication Officer appointed under Section 71 of RERA cannot be considered for the purposes of meeting the member composition mandate under Section 21 of RERA.”

Pimenta pointed out that the Real Estate (Regulatory and Development) Act, 2016, also stipulates the disposal of complaints within 60 days. However, MahaRERA struggles to achieve this due to the state government’s failure to fill vacancies. Pimenta suggested, “When filling the vacancies, the state should appoint members with a judicial background instead of retired IAS officers.”

Dsouza concluded “We have written to the chief minister, the deputy chief minister, and the Chief Justice of the Bombay High Court to address the appointment of additional members,” added Dsouza, emphasizing the urgent need for action.

The delays and backlog faced by MahaRERA have left home buyers in Maharashtra frustrated and disillusioned. The Real Estate (Regulatory and Development) Act, 2016, which was established to protect buyers from unscrupulous developers, seems to have fallen short of its intended purpose due to the inefficiencies within the regulatory body.

The lack of timely hearings and prolonged resolution processes have forced many home buyers to seek alternative avenues for justice, such as consumer courts. This not only adds to their legal expenses but also undermines the credibility and effectiveness of MahaRERA.

As the number of complaints continues to rise, it becomes imperative for the state government to take immediate action to address the vacancies within MahaRERA. Appointing additional members, particularly those with a judicial background, would help expedite the hearing process and clear the mounting backlog of cases.

The MahaRERA authorities must also consider implementing measures to streamline their operations and ensure efficient complaint resolution. By adhering to the mandated 60-day timeline for complaint disposal and providing regular hearing dates, MahaRERA can restore confidence among home buyers and fulfill its intended role as a reliable platform for seeking justice.

The plight of home buyers like Jayshree Sukhadia serves as a stark reminder that the real estate sector in Maharashtra requires a robust and responsive regulatory framework. Only through timely and effective dispute resolution can the interests of home buyers be protected and the trust in the real estate market be restored.

It is now up to the concerned authorities to address the concerns raised by home buyers, legal experts, and associations like the MahaRERA Bar Association and the Watchdog foundation. By taking immediate action to fill vacancies, appoint qualified members, and streamline the complaint resolution process, MahaRERA can regain its credibility and ensure justice for home buyers across Maharashtra.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram