If you don’t pay your loan on time, did you know that banks can invoke the Sarfaesi Auction Act? This means that if you default on your home loan payments, banks can put your property up for auction. Recently, a famous Bollywood star, Sunny Deol, was in the news for defaulting Rs 56 crore loan from the Bank of Baroda, and the bank prepared an auction notice for his property. Although the auction notice was later withdrawn and the outstanding dues were discussed, this was one of those rare times when a bank stepped up against loan defaults. In this article, we’ll explore what the Sarfaesi auction means and how potential home buyers can benefit from it.

What is the Sarfaesi Auction?

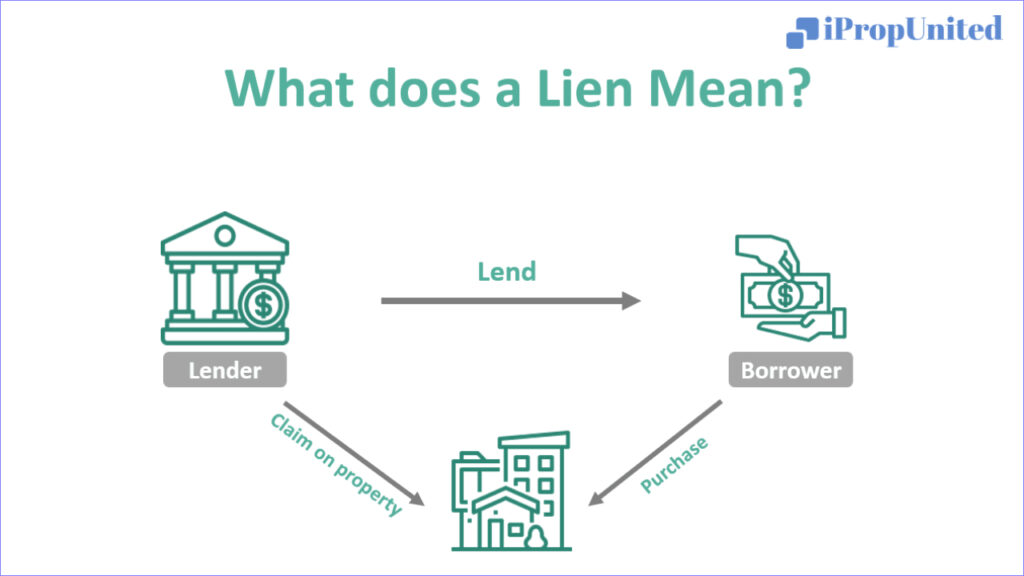

The Sarfaesi auction process, also referred to as the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest auction, is a well-established legal mechanism in India that enables banks and financial institutions to recover their dues from borrowers who have defaulted on their loans. The Sarfaesi Act empowers banks to take possession of the collateral pledged by the borrower and sell it off to recover the outstanding loan amount. The auction is conducted by the bank or a designated agency, and prospective buyers can bid for the property or asset being auctioned.

The Sarfaesi auction is primarily utilized for the recovery of Non-Performing Assets (NPAs) in the banking industry. This process provides a transparent and efficient mechanism for banks to recover their funds and reduce bad loans.

What are the key steps of the sarfaesi auction?

The basic steps of a sarfaesi auction include-

- Collateral seizure: The provision of collateral by the borrower may be subject to seizure and possession by banks.

- Auction process: The asset or property is put up for auction in order to recoup the remaining loan balance.

- Transparency: The auction is held in a transparent manner to ensure fair participation and bidding.

- Recovery of dues: The funds collected from the auction are used to recoup the dues of the financial institution or bank.

The Sarfaesi auction has played a significant role in resolving the issue of home loan defaults and enhancing the financial well-being of banks in India. Nevertheless, this auction can also provide an opportunity for potential property buyers seeking a good bargain. What types of properties could one anticipate bidding on at a bank auction of this nature? The subsequent section elucidates the finer details of the Sarfaesi auction.

What is included in the Sarfaesi auction?

The Sarfaesi Act, enacted in 2002, pertains to immovable assets of high value, irrespective of their nature or structure. Below is a brief overview of the different types of properties and the process followed by banks to conduct a sarfaesi auction.

Types of properties

The Sarfaesi auction encompasses the sale of properties seized by banks due to non-repayment of loans. The properties offered for sale may vary in type and include residential, commercial, industrial, and agricultural plots or properties.

Procedure

The process of auctioning begins with the bank issuing a notice to the borrower, allowing them a period of 60 days to repay the outstanding amount. In case of failure to do so, the bank proceeds with the auction process. The initial step in the process involves the appointment of a certified valuer to assess the fair market value of the collateral. The auction notice is then published in leading newspapers, on the bank’s website, and other e-auction portals, providing details of the property, reserve price, and auction date.

Prospective buyers who are interested in acquiring the property may take part in the auction by submitting their bids along with the required deposit. The highest bidder will be announced as the successful bidder, and the bank will verify the sale. The successful purchaser is required to settle the outstanding balance within 15 days, failing which the deposit will be forfeited.

Transparency

Ensuring transparency in the process of seizing and selling properties is of utmost importance in auctions. The financial institutions involved provide comprehensive details about the properties, including their location, size, and condition. Furthermore, prospective buyers are permitted to conduct thorough inspections of the properties before participating in the auction.

How does a sarfaesi auction benefit potential buyers?

A Sarfaesi auction can benefit both banks and buyers,

- It is a quick and efficient way for banks to recover their NPAs.

- The auction process is transparent and open to public participation.

- Buyers can potentially get properties at lower prices compared to the market value.

However, borrowers must be aware of their rights and obligations under the Sarfaesi Act to avoid losing their assets through auction. It is also important for borrowers to keep important auction ownership documents on hand to avoid future conflicts. Losing the sale certificate can be detrimental for an auction buyer.

What is a sale certificate and why is it important for a sarfaesi auction buyer?

The Sale Certificate is a crucial document issued by an authorized officer under the Sarfaesi Act, 2002. This certificate is provided to the successful bidder in a Sarfaesi auction, confirming that they now own the property. The certificate serves as evidence of the purchase and is necessary for the buyer to take possession of the property.

What does the sale certificate include?

When you receive a sale certificate, there are a few important elements that you should pay attention to. These elements include:

- the property’s details like its address, size, and boundaries

- the name of the buyer and the purchase price.

- the certificate should also mention any encumbrances or liabilities attached to the property.

It’s important to note that the sale certificate is legally binding and provides protection to the buyer against any third-party claims. The certificate is issued only after the full payment of the bid amount and other applicable charges. Before taking possession of the property, the buyer should carefully review the certificate and ensure its accuracy.

How to register for the sarfaesi auction?

If you are interested in participating in a Sarfaesi auction, it’s important to know the steps involved in registering for it. The Reserve Bank of India (RBI) has approved an e-auction platform for this purpose. Here’s a step-by-step guide on how to register:

Step 1: Visit the approved e-auction platform by the RBI.

Step 2: Register yourself by providing and verifying your personal details and completing the Know Your Customer (KYC) form.

Step 3: Browse through the available properties and select the ones you are interested in.

Step 4: To place a bid, pay the EMD (Earnest Money Deposit).

Step 5: Carefully review the property details and place your bid!

It’s worth noting that while Sarfaesi auctions offer the opportunity to buy properties at a lower cost, there are certain parameters to consider, such as the condition of the property and any issues that may arise after possession, as these will no longer be the bank’s liability. If you’re considering participating in a Sarfaesi auction, it’s advisable to consult a legal expert first.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram