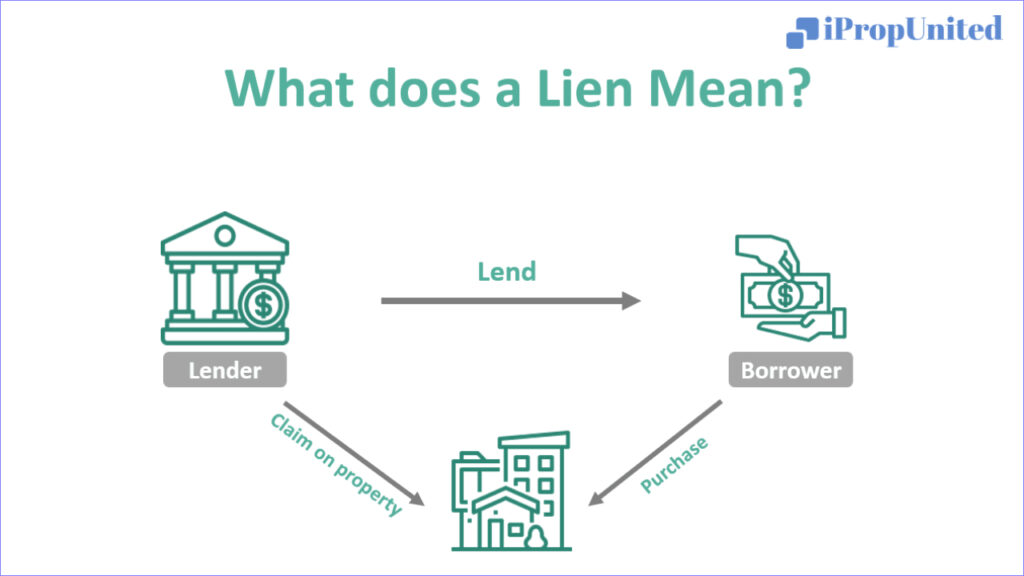

Buying a home or a car is a big financial commitment that can be difficult. Banks need assurance that they’ll get their money back, which is why they require collateral before approving loans. If you can’t make your loan payments, the bank can take your collateral by invoking a legal right called a lien. A lien can come in different forms and has hazards that you should know about.

Banks are obligated to justify their spending, just like you are. A lien helps banks recover non-performing loans. But does it guarantee loan fulfillment even if you can’t make timely payments? How does a lien affect your ability to transfer your homeownership rights? This page answers all these questions and more, starting with a definition of what a lien is.

Definition of Lien

A lien is a legal claim that gives a creditor the right to take possession of a property as security for a debt that is owed. Various entities, such as government agencies, banks, and financial institutions, can place a lien on a property when the owner is unable to repay a loan or mortgage. This ensures that the creditor can recover their investment in the property.

The Procedure

When a borrower has not repaid a loan, a lien may be used to recover the unpaid balance. The court or creditor will first give the borrower enough time to pay the outstanding amount before taking further action. However, if the borrower is unaware of the court proceedings or the creditor’s requests, the institution may legally or illegally claim their property, resulting in a lien.

It’s important for banks and other organizations to inform borrowers about liens before any legal documents are signed. Both the borrower and creditor usually agree on the collateral or security before it is formally recorded in writing and signed. Financial institutions have an advantage when it comes to floating liens because the asset or inventory is not predetermined or fixed.

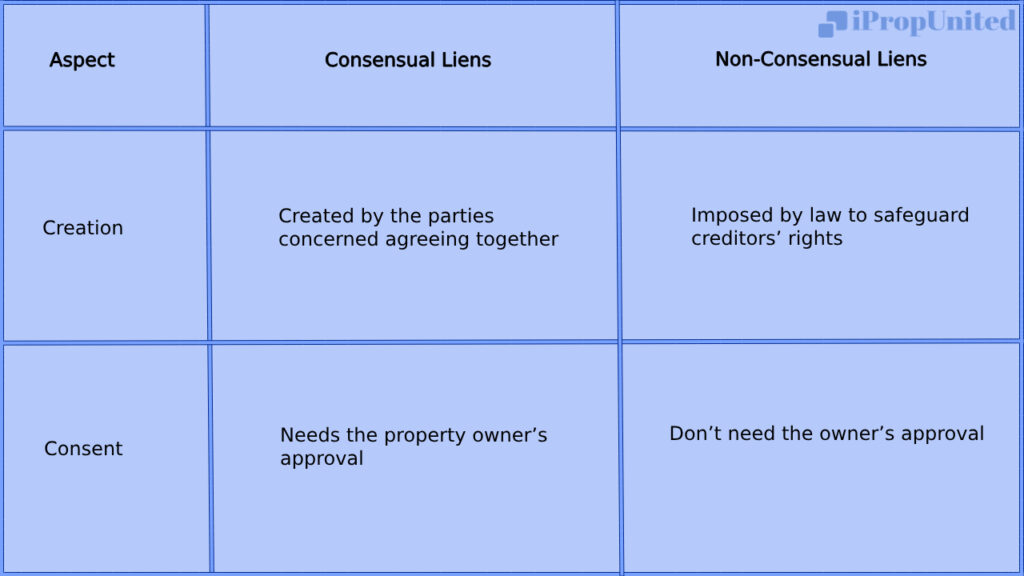

Consensual vs non-consensual lien differences

The two categories of liens are non-consensual and consenting. See the table below for a side-by-side comparison.

Understanding the difference between voluntary and involuntary liens is crucial when it comes to property ownership and debts.

Different Types Lien

Liens are legal claims that can be made on real estate in India for various reasons. There are several types of liens that can be imposed on a property. Here are some of them:

Tax liens: If property owners don’t pay their taxes, the government may impose a tax lien on their property. This means that the government can take possession of and sell the property to recover the unpaid taxes. Municipal corporations at the local level frequently impose tax liens in India.

Real estate liens: These liens are imposed to protect a property owner’s debt. They are filed by contractors, mortgage lenders, and other parties who have provided services or loans related to the property. Banks and financial institutions frequently use real estate liens in India to secure home loans.

Bank liens: Similar to real estate liens, bank liens are imposed by banks to protect the amounts owed by the property owner. These liens may be placed for a variety of reasons, including unpaid credit card debt or outstanding loans. Banks often use liens in India to recover unpaid loan balances.

Judgement liens: These liens are imposed by the court when a property owner is the subject of a court order. The creditor is authorized to take possession of and sell the property to pay off the outstanding balance. In India, judgement liens are frequently used to collect unpaid penalties or damages imposed by the court.

Mechanic’s liens: These liens can be filed by contractors or suppliers who have provided labor or materials for building or restoration projects. The supplier or contractor is authorized to take and sell the property to recover the outstanding payment. The construction sector in India frequently uses mechanic’s liens.

It is important for property owners to understand the different types of liens and their implications. Seeking advice from a real estate advisor or legal expert can be helpful when dealing with liens.

The removal of property liens

A property lien can prevent the sale or transfer of a property until the obligation is either settled out of court or paid in full. To remove a property lien, you can take several actions, including the following:

Gather information: Find out the details of the lien, such as the creditor’s name, the filing date, and the amount owed, to make an informed decision on what to do next.

Negotiate or pay off the debt: If you have the money to do so, try to settle the debt through negotiation with the creditor. Alternatively, you can pay off the debt entirely. Once the debt has been paid in full, the lien may be released.

File a release of lien: When the debt has been settled, you must submit a release of lien with the appropriate authorities, such as the local land records office. This paperwork formally removes the lien from the property.

Seek legal assistance: If you encounter any difficulties in removing the lien, it is important to seek legal counsel. A real estate attorney can guide you through the appropriate steps and help you achieve a smooth resolution.

Final Thoughts

It is important to note that a lien can have negative effects on both creditors and borrowers. For instance, it can decrease the property’s value, lead to legal issues, and affect property insurance. Before finalizing a contract, it is advisable to consult with a legal expert to fully understand the lien’s implications and how it may affect your loan payment or purchase.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram