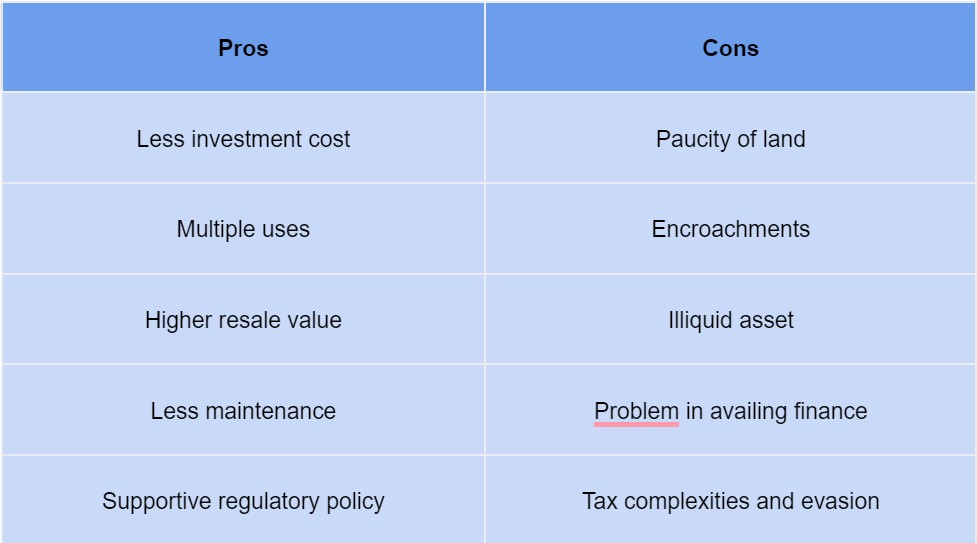

Investing in land is often considered a good option as it can provide higher returns than other real estate investments. However, before you decide to invest in land, it’s important to understand the advantages and disadvantages of this type of investment. This article explores the pros and cons of investing in land to help you make an informed decision.

Real estate is one of the most popular investment options in India, and among the various types of properties, land is the most preferred. This is because land investments generally offer higher returns, better resale value, and lower maintenance costs. However, it’s important to evaluate the investment properly before making a decision. Like any other financial product, land investment has some downsides, such as limited availability and tax-related issues.

Advantages and Disadvantages of land investment

Advantages

Investing in land can be a wise decision for those looking to enter the real estate market. Here are some advantages to consider:

Low investment cost: Purchasing a property in metro cities such as Delhi, Mumbai, and Bangalore can be challenging due to high property prices. Investing in a plot of land in emerging areas can offer an easier entry point into the market. Residential plots in peripheral areas of cities are often available at more competitive prices than established areas or city centers. For example, buying a land parcel in outer areas of Mumbai, such as Palghar, Manor, Boisar, and Dahanu, can be a lucrative option for those looking to invest in their second or vacation homes.

Multiple uses: One of the biggest benefits of buying land is the ability to customize it for any future use. Land can be used for poultry farming, agriculture, or to construct a house. Investors can also sell the land to a developer for the construction of residential or commercial developments or enter into a joint venture agreement with a real estate developer under RERA. This not only provides an exit route but also allows investors to attain their share of profit in the form of a newly constructed unit.

Higher resale value: The rate of appreciation on land is higher than constructed properties as land remains in the same condition, barring natural impact caused due to weather or erosion. Additionally, a limited supply of land ensures higher competition in the market, ushering in increased price points.

Less maintenance: The cost of maintaining a plot is usually less than that of a constructed property. Investors do not have to worry about recurrent repairs or revamps. Apart from mowing the area or fencing and hiring a guard for surveillance, plots do not involve additional maintenance.

Improved norms: The Real Estate (Regulation and Development) Act, 2016 (RERA) has brought in a sea change in the real estate norms and regulations. Not only does it tighten the noose on realtors to adhere to the changed norms, but also brings in increased transparency and accountability. For instance, for those who invest in residential plots, the requirement is that the land plot must be RERA registered.

Digitization of land records and maps: The Union and State governments are undertaking a massive exercise to digitize old maps and land records. This is a positive for land investments as it will usher in more transparency and clarity. The digitization process will enable easy translation for such land records. The simplification of access to land records will enhance the attractiveness of land investments.

Disadvantages of land investment

Investing in land has its advantages, but it also has some limitations. Here are some things to keep in mind:

Availability of land is a concern: While demand for land is always increasing, supply is decreasing. With a growing population and infrastructure projects, land availability has decreased, especially in cities. If you’re looking to buy land in a Tier I city, you may only find land on the outskirts.

The land is susceptible to encroachments. Illegal confiscation of land is a common problem, with many cases reported across the country. This can be a costly legal issue to resolve. If you’re buying agricultural land, it’s important to check ownership details for the last 30 years. The government can take agricultural land for infrastructure or commercial projects.

Reselling land can be complicated: While land value appreciates quickly, finding a buyer willing to pay a higher price can be a challenge. Compared to other financial products, such as gold or mutual funds, land cannot be immediately sold when you need to cash out. It may take years to find a suitable buyer.

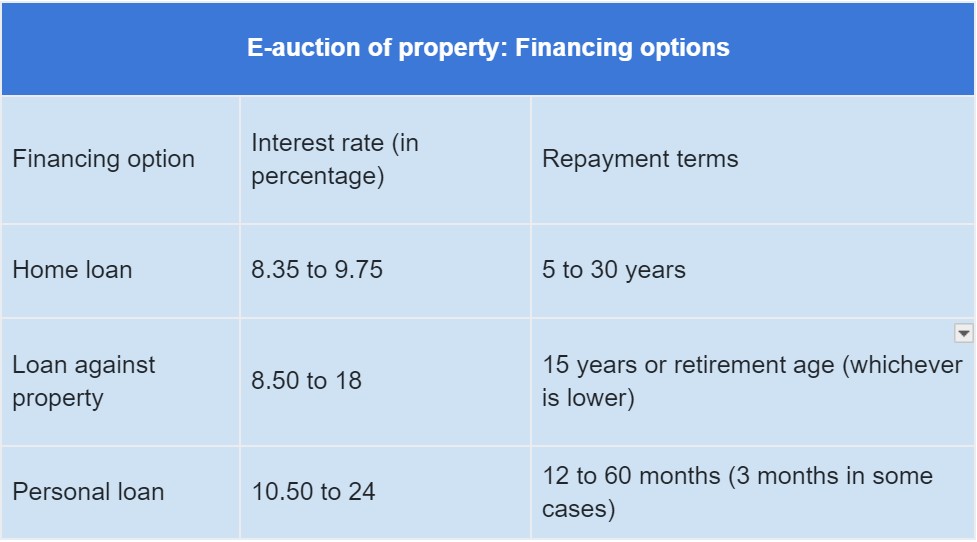

Getting a loan for land purchase can be difficult: Banks are hesitant to lend money for land purchases due to fraud associated with plot deals. Banks prefer to lend money for land purchases from renowned builders.

Taxation and compliance issues can be complex: Investment in land requires an understanding of tax laws, especially in the post-RERA regulatory environment. Failure to comply can result in penalties. Unlike home loans, there are no tax benefits for interest paid on loans for land investment. Property tax rates in cities across India increase steadily, putting an additional burden on landowners.

Emerging trends in India’s real estate land investment sector

According to a recent interview with Niranjan Hiranandani, a prominent figure in the real estate industry, there is a forecasted boom in the realty sector in 2024. Mr. Hiranandani predicts a 15 percent growth across the board, citing a hopeful change in the system and a decrease in non-performing assets (NPAs) to less than 1.5 percent, the lowest in any sector. Additionally, factors such as middle-class expansion, upcoming developments, and continued governmental support are expected to contribute to the promising outlook for land investments in India.

Bottom line

Investing in land presents a myriad of opportunities and challenges that require careful consideration. The digitization of land records further enhances transparency and accessibility. Despite these challenges, the emerging trends in India’s real estate sector indicate a positive outlook with anticipated growth and government support.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram