Buying properties online is now possible too! With e-auctions, you can bid for properties from the comfort of your home. But how does it work? Read on to find out everything about e-auction property.

Now, property auctions have moved to the online space. Banks and private sellers have put up their properties for bidding, so you have a lot of options. However, you should also be aware that e-auction properties have certain legal and tax implications. This article covers everything you need to know about e-auction properties, including their meaning, the things you should consider, financing options, and more.

Meaning

E-auction is a modern way of buying and selling properties online. It allows people to participate in the auction from any location. E-auctions are popular in India because they are easy to use. During an e-auction, buyers can bid for properties online instead of going to a physical location. This makes the process more efficient and transparent. It also enables people to participate from the comfort of their own homes.

Factors to consider when purchasing

If you’re planning to buy a property at an online auction, there are some things you should keep in mind to increase your chances of making a successful purchase.

Research the property: You need to research the property you’re interested in. This is important to avoid legal issues in the future. Before bidding, check the location, amenities, legal status, pending litigations, and encumbrance certificate.

Set a budget: It’s important to set a budget for your purchase. You’ll want to make sure you’re not overspending and that you’re making a profitable investment. Before you bid on a property, research its market value, possible renovation costs, and additional taxes.

Understand the auction process: You should also have a basic understanding of the auction process. Make sure you know the bidding rules, registration process, and any additional fees or charges associated with participating.

Verify the seller: It’s important to verify the credibility and authenticity of the seller before making a purchase. Check if they have the legal rights to sell the property and obtain all necessary documents to avoid any legal complications in the future.

Inspect the property: Before making a final decision, it’s a good idea to visit the property and inspect it thoroughly. Check for any potential issues that may require repairs or maintenance in the future.

Seek professional advice: Consult with a trusted lawyer to get valuable insights about the process and guidance about making the final decision.

Pros and cons

E-auctions of properties come with their own set of advantages and disadvantages.

The advantages are:

Lower Prices: Properties sold at e-auctions generally start with lower bids, presenting an opportunity for buyers to purchase real estate at a discounted price.

Wide Selection: E-auctions offer a broad range of properties, including residential, commercial, and industrial, providing buyers with more options to choose from.

Transparency: E-auctions are conducted online, which ensures transparency in the bid process, allowing buyers to view the current highest bid and make informed decisions.

Convenience: Buyers can participate in e-auctions from the comfort of their homes, eliminating the need to physically visit multiple properties.

The disadvantages are:

Competition: E-auctions are open to a larger number of buyers, resulting in increased competition, and potentially driving up the final bidding price.

Inspection Challenges: Buyers may face difficulties in inspecting the property before bidding, as online auctions often provide limited opportunities for physical visits.

Uncertain Property Condition: E-auction properties are sold “as-is,” which means that buyers may encounter unexpected issues or repairs after the purchase.

Legal risks:Buyers should conduct thorough research on the legal status and ownership history of the property to avoid potential legal complications.

Financing options

When purchasing a property at an e-auction, it is crucial to consider the financing options available to you. Here are some options to consider:

Home loan

A home loan is a popular financing option for property purchases, including the ones bought at an e-auction. Banks and financial institutions offer home loans with competitive interest rates and flexible repayment terms.

Loan against property

If you already own a property, you can opt for a loan against the property to finance the purchase at an e-auction. This type of loan allows you to borrow against the value of your existing property, providing you with the funds needed for the purchase.

Personal loan

In some cases, you may consider a personal loan to finance the purchase. However, personal loans generally have higher interest rates compared to home loans or loans against property. Hence, it becomes essential to carefully consider the terms and conditions before opting for a personal loan.

Self-financing

If you have sufficient funds available, you can choose to self-finance the purchase. This eliminates the need for a loan and allows you to directly purchase the property at the e-auction.

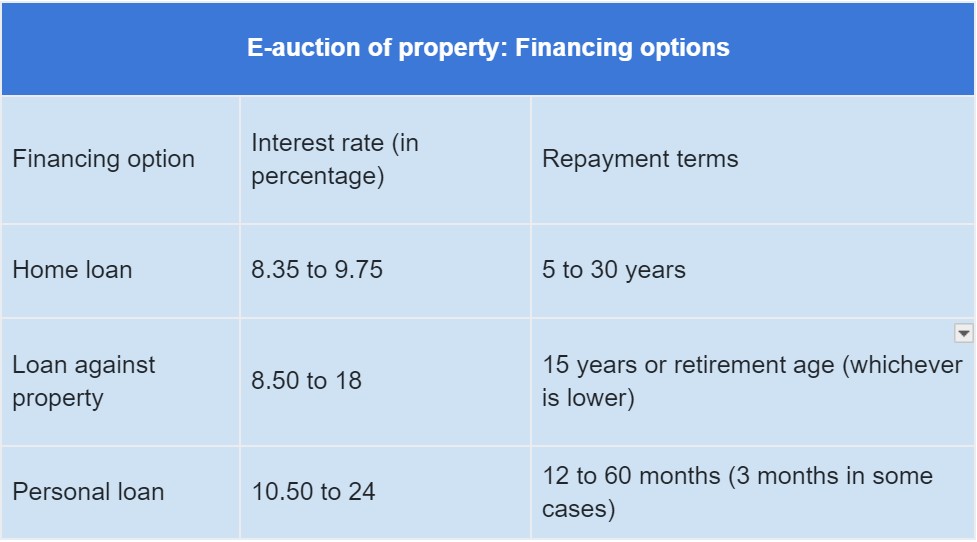

Here are the interest rate and repayment terms for the most popular financing options:

It’s a good idea to talk to a financial advisor and compare the interest rates, repayment terms, and other charges associated with different financing options before making a final decision.

Income tax implications

Acquiring property through an e-auction may present an opportunity for a profitable investment, but it is crucial to take into account the income tax implications involved. To this end, it is vital to keep in mind the following key points:

Capital gains tax: Upon selling the property in the future, any gain realized will be subject to capital gains tax. The tax rate applicable depends on the duration of property ownership. If the property is held for less than two years, it will be treated as a short-term capital asset and taxed at the applicable income tax slab rate. If held for more than two years, it will be considered as a long-term capital asset and taxed at a flat rate of 10 percent after adjusting for inflation.

Stamp duty and registration charges: While purchasing property through an e-auction, stamp duty and registration charges are payable. These expenses are deductible from the total cost of the property to calculate capital gains tax.

Rental income: The property can be rented out, and any income earned will be taxable based on the tax slab rate if the Gross Annual Value exceeds Rs 2.5 lakh.

Loan interest deduction: If a loan was taken to acquire the property, a deduction can be claimed for the interest paid on the loan under Section 24(b) of the Income Tax Act. The maximum deduction allowable is Rs two lakh per year.

Tax benefits for first-time buyers: First-time homebuyers may be eligible for additional tax benefits under Section 80EEA. This allows for a deduction of up to Rs 1.5 lakh on the interest paid on home loans, subject to specific conditions.

Thanks to the convenience associated with e-auctions, they have become increasingly popular in India. If you are considering participating in one, it is advisable to begin your research on the available property options, assess your budget, and proceed accordingly.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram