Real estate assets have inherent characteristics determining their true potential to perform and define their intrinsic value. This value is determined by various factors such as location, market demand, upcoming developments, and other relevant aspects. If you’re looking to invest in real estate, it’s essential to understand the definition of intrinsic value and how it can impact your investment.

Investors put their money into properties or plots of land, expecting their value to rise over time. This can be due to infrastructural developments in the region, such as upcoming metro networks. Factors such as upcoming infrastructural developments or easy access to amenities add an inherent value to a property, known as intrinsic value. For a real estate investor, understanding the intrinsic value of a property is crucial. Read on to learn more about the intrinsic value definition and its various crucial aspects.

Intrinsic value definition in real estate

The intrinsic value of a property is what it’s really worth based on what it has and how it can be used. This includes things like where it is located, how big it is, what features it has, and how many people want it. Unlike market value, which can change a lot because of things outside of the property, intrinsic value is more about how good of an investment the property is in the long run.

Let’s say there are two properties – a shop and a house. The shop is in a really busy area with many people passing by and great transport links. The house has all the latest features and is close to schools, hospitals, and shops.

Because of these things, the shop and the house are worth more than other similar shops and houses that aren’t in such great locations or don’t have all the modern features.

People who invest in property use the worth of the property (called intrinsic value) to determine whether they will make a profit or not. They use this information to decide whether to buy, sell, or invest in the property.

How to calculate intrinsic value?

If you want to know how much an asset is really worth, you can use a method called “discounted cash flow.” Basically, you try to predict how much money the asset will make in the future and then adjust that amount to account for the fact that money is worth less in the future. The formula looks like this:

DCF = CF1/(1+r)1 + CF2/(1+r)2 + TV/(1+r)n

Where,

CF = Expected cash flow for a particular period (CF1 is cash flow for year one)

r = Discount rate

TV = Terminal value (expected cash flow after the period of projection)

n = Specific period (Months, quarters or years)

Don’t worry too much about the formula. Just know that it helps you determine how much an asset is worth based on what you think it will earn.

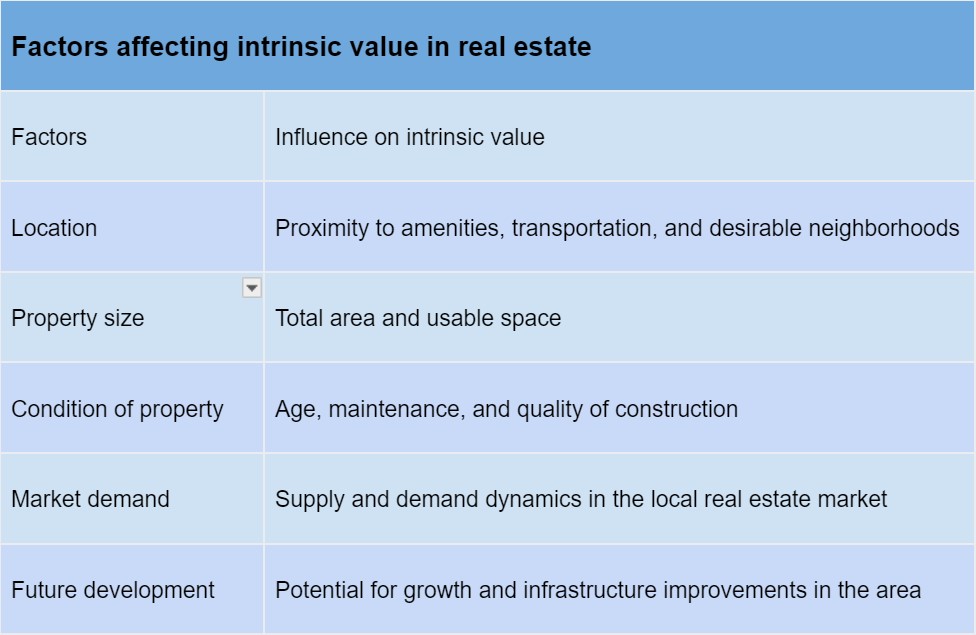

Factors influencing intrinsic value in real estate

Factors that affect the intrinsic value of a property are shown in the table below:

Difference between intrinsic value and current market value

Understanding the difference between intrinsic value and current market value is of utmost importance in the world of real estate. Although these two terms are often used interchangeably, they carry distinct meanings that set them apart.

Intrinsic value

Intrinsic value refers to the true worth of a property based on its underlying characteristics and potential. This includes aspects such as location, size, amenities, and condition. Intrinsic value is determined by a thorough analysis of the property’s features and its long-term earning potential.

Market value

Conversely, current market value is the price at which a property can be bought or sold in the current market. It is influenced by a myriad of factors, such as supply and demand, economic conditions, and buyer preferences. Market value can fluctuate over time due to changing market conditions.

It is important to note that market value may not always reflect the intrinsic value of a property. Occasionally, a property may be undervalued or overvalued in the market.

Therefore, understanding the distinction between intrinsic and current market value is essential in making informed decisions in real estate. While intrinsic value provides a comprehensive perspective of a property’s worth based on its inherent qualities, market value reflects the price at which it can be bought or sold in the current market.

How to improve the intrinsic value of property?

Maximizing returns on real estate investments requires increasing the intrinsic property value. Here are some effective strategies:

Renovate and upgrade: Upgrading your property can significantly increase its value. Consider modernizing your kitchen and bathrooms, making your home more energy-efficient with insulation and solar panels, or giving it a fresh coat of paint.

Improve your curb appeal: The way your property looks from the street is important. Invest in landscaping, keep your lawn tidy, and add features like a garden or patio to make it more inviting.

Location and amenities: Where your property is located is important to its value. Highlight the benefits of the area, such as proximity to schools, shopping centers, and transportation. Emphasize any unique amenities your property has, like a swimming pool or gym.

Make the most of your space: Optimize your layout to make the most of your available space. Consider turning unused areas into functional spaces like a home office or guest room. This can make your property more appealing to buyers or renters.

Maintenance and repairs: Regular maintenance and quick repairs are essential to maintain your property’s value. Make sure your plumbing and electrical systems are working well, and address any structural issues promptly.

Final Thoughts

Whether you’re new to real estate investing or selling your property, make sure you consider the intrinsic value of the property before making a decision. Research the current value and potential for future growth.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram