In the intricate dance of real estate transactions, accurately gauging the worth of your property stands as a pivotal act. A misstep in this delicate balance can either repel potential buyers with lofty pricing or leave you counting losses with an underestimated tag. It’s in this nuanced realm that the process of real estate appraisal emerges as the guiding force, steering you towards the right valuation for your property. This article dives into the intricacies of this pivotal process.

Termed as property valuation, real estate appraisal unfolds as the meticulous journey of determining the intrinsic value or market price of a property. Whether you lack the time or inclination to dissect every component for a precise figure or have already set a price but seek a professional nod of approval, undergoing an appraisal proves to be a wise move. It’s the assurance that you’ve pegged your property at the sweet spot in the market.

Let’s unravel the intricacies of the two principal methods employed in property appraisal –

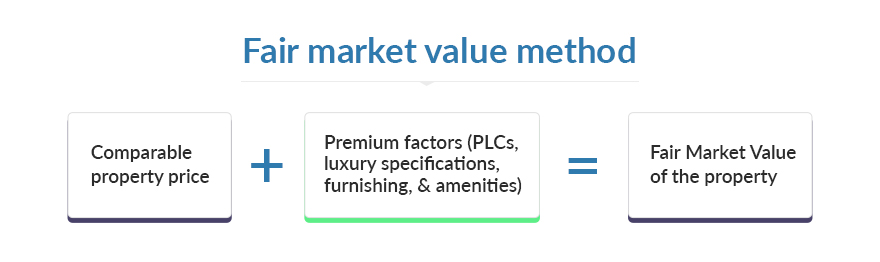

Fair Market Value (FMV) Method

The FMV method, a go-to for ready-to-move properties, earns its popularity for its simplicity. Here, the focus centers on identifying comparable properties. These comparables, ideally within a stone’s throw, listed within one to three months, and mirroring your property’s size and configuration, lay the groundwork.

Enter the premium factors unique to your property, such as Preferential Location Charges (PLCs) – an extra layer for units with superior locations. Think park-facing delights or coveted floors within the same complex, with PLCs ranging from Rs 50 to 150 per sq ft.

Factor in the allure of luxury specifications – lavish flooring and kitchen renovations – and amenities that elevate your property, like a private swimming pool or an internal park within the housing society. The amalgamation of these elements births the Fair Market Value, a bespoke valuation for your property.

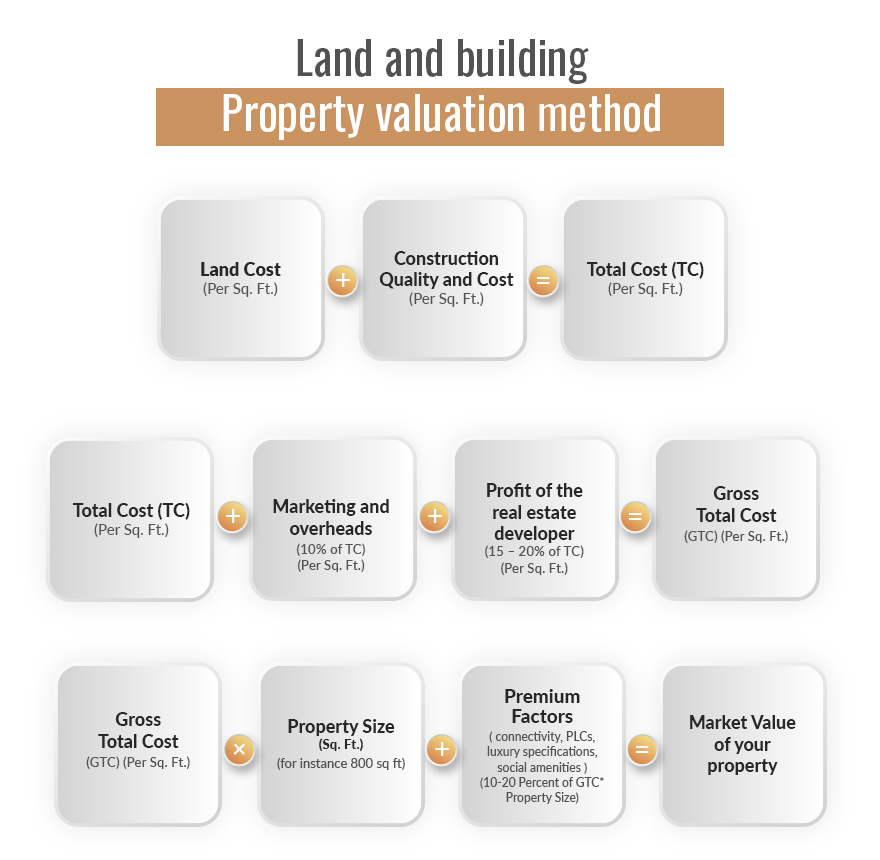

Land and Building (L and B) Method

Stepping into the technical arena, the Land and Building method takes center stage, particularly for under-construction or freshly-completed properties. Surprisingly, it often steps in for ready-to-move properties under the discerning eye of seasoned real estate appraisers.

Here, the legal facets of the property undergo scrutiny – a meticulous examination of identification documents, including title deeds and mutation certificates, unfurls during the appraisal process.

While some property appraisers may demand a fee ranging from 0.1 to 0.3 percent of the total property value, others opt for a flat charge, typically falling between Rs 10,000-20,000. Despite the additional cost, the wisdom lies in recognizing that this investment secures professional counsel on pricing, a linchpin in the intricate dance of property sales.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram