The ratio used to determine a company’s value that compares its current share price to its earnings per share (EPS) is known as the price-to-earnings ratio. Other names for the price-to-earnings ratio include the price multiple and the earnings multiple.

Investors and analysts use P/E ratios to assess the comparative value of a company’s shares in an apples-to-apples comparison. A company’s performance can also be evaluated against its prior performance, and aggregate markets can be contrasted with one another or over time.

P/E can be calculated on a trailing (backward-looking) or forward (projected) basis.

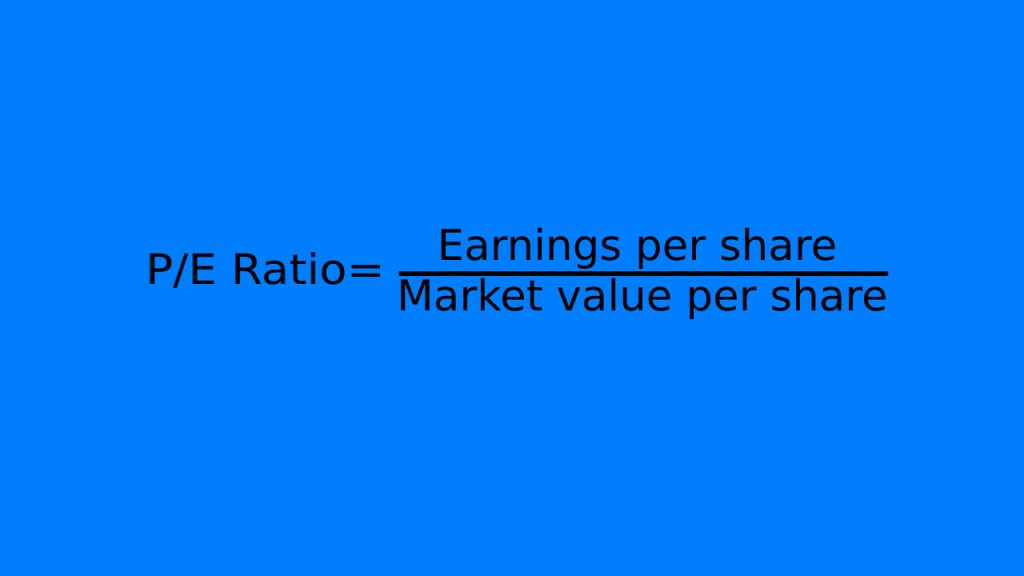

Formula and Calculation for P/E Ratio

The following is the calculation and formula used for this process.

Simply divide the current stock price by the earnings per share (EPS) to calculate the P/E ratio.

The current stock price (P) can be found by simply entering a stock’s ticker symbol into any finance website, and while this concrete value reflects what investors must currently pay for a stock, the EPS is a slightly more nebulous figure.

EPS comes in two main varieties. TTM is a Wall Street acronym for “trailing 12 months”. This number signals the company’s performance over the past 12 months. The second type of EPS is found in a company’s earnings release, which often provides EPS guidance. This is the company’s best-educated guess of what it expects to earn in the future. These different versions of EPS form the basis of trailing and forward P/E, respectively.

Understanding the P/E Ratio

One of the most popular methods for investors and analysts to estimate a stock’s relative value is the price-to-earnings ratio (P/E). If a stock is overvalued or undervalued, the P/E ratio can help you decide. Another way to benchmark a company’s P/E is to compare it to other stocks in the same sector or to the overall market, such as the S&P 500 Index.

The P/E 10 or P/E 30 measures, which average the prior 10 or prior 30 years of earnings, respectively, are sometimes taken into consideration by analysts who are interested in long-term valuation trends. These longer-term measures can account for changes in the business cycle, which is why they are frequently used when attempting to determine the overall value of stock indices like the S&P 500.

From a low of about 5x (in 1917) to over 120x (in 2009, just before the financial crisis), the P/E ratio of the S&P 500 has fluctuated. The long-term average P/E for S&P 500 is approximately 16x, which means that the stocks that make up the index are collectively valued at a premium of 16 times higher than their weighted average earnings.

Forward Price-to-Earnings

The two most popular P/E ratios are forward P/E and trailing P/E, and both of these EPS metrics are taken into account. Using the average of the previous two actual quarters and the forecasted results for the following two quarters is a third, less popular variation.

Instead of using trailing numbers, the forward (or leading) P/E makes use of future earnings guidance. This forward-looking indicator, also known as “estimated price to earnings,” is helpful for comparing current earnings to projected earnings and for painting a more accurate picture of what earnings will look like—without changes and other accounting adjustments.

The forward P/E metric has drawbacks though, one of which is that businesses might understate earnings in order to beat the estimated P/E when the results for the following quarter are announced. Other businesses might overestimate the amount and then reduce it before announcing their next earnings. In addition, estimates from outside analysts could differ from those made by the company, confusing the situation.

Trailing Price-to-Earnings

The current share price is divided by the total EPS earnings over the previous 12 months to calculate the trailing P/E, which is based on past performance. Assuming the company accurately reported earnings, it is the most popular P/E metric because it is the most objective. Since they don’t trust other people’s earnings estimates, some investors prefer to look at the trailing P/E ratio. However, the trailing P/E has some drawbacks as well, namely that a company’s past performance does not predict its future behavior.

As a result, investors should make investments based on future earnings potential rather than past performance. Another issue is that the EPS number remains constant while stock prices fluctuate. If a major company event significantly raises or lowers the stock price, the trailing P/E will be less reflective of those changes.

The trailing P/E ratio will fluctuate along with the price of a company’s stock because earnings are only reported once a quarter while stocks are traded continuously. Some investors favor the forward P/E as a result. Analysts anticipate higher earnings if the forward P/E ratio is lower than the trailing P/E ratio; analysts anticipate lower earnings if the forward P/E ratio is higher than the current P/E ratio.

Valuation From P/E

One of the most popular stock analysis tools used by investors and analysts to determine stock valuation is the price-to-earnings ratio, or P/E. The P/E ratio can reveal more than just whether a company’s stock price is overvalued or undervalued. It can also show how a stock’s valuation measures up to that of its sector or a benchmark like the S&P 500 Index.

The price-to-earnings ratio essentially tells investors how much money they should put into a company in order to get $1 of earnings from that company. The P/E ratio, which indicates how much investors are willing to pay per dollar of earnings, is sometimes referred to as the price multiple for this reason. If a company is currently trading at a 20x P/E multiple, this means that an investor is willing to pay $20 for $1 of current earnings.

The P/E ratio aids investors in estimating a stock’s market value in relation to its earnings. In essence, based on past or projected earnings, the P/E ratio reveals the price the market is willing to pay for a stock at the present time. A high P/E could indicate that a stock is overvalued and its price is high in relation to its earnings. On the other hand, a low P/E might suggest that the current stock price is undervalued in comparison to earnings.

Example of the P/E Ratio

As an example, calculate the P/E ratio for Walmart Inc. (WMT) on February 3, 2021, when the company’s stock closed at $139.55.2. According to The Wall Street Journal, the company’s earnings per share for the fiscal year ending January 31, 2021 were $4.75.

As a result, Walmart’s P/E ratio was:

$139.55 / $4.75 = 29.38

Comparing Companies Using P/E

As another example, we can compare the P/E ratios of two financial companies to see which is relatively over or undervalued.

The following statistics were reported by Bank of America Corporation (BAC) at the end of the year 2020:

- Stock Price = $30.31

- Diluted EPS = $1.87

- P/E = 16.21x ($30.31 / $1.87)

In other words, Bank of America was trading at about 16 times trailing earnings. However, unless you have something to compare it to, such as the stock’s industry group, a benchmark index, or Bank of America’s historical P/E range, the 16.21 P/E multiple is meaningless.

Bank of America’s P/E at 16x was slightly higher than the S&P 500, which over time trades at about 15x trailing earnings. To compare Bank of America’s P/E to a peer’s, we can calculate the P/E for JPMorgan Chase & Co. (JPM) as of the end of 2020 as well:

- Stock Price = $127.07

- Diluted EPS = $8.88

- P/E = 14.31×5

The stock of Bank of America does not seem as overvalued when compared to the average P/E of 15 for the S&P 500, as it did when you compare its P/E of 16x to JPMorgan’s P/E of roughly 14x. In comparison to JPMorgan and the overall market, Bank of America’s higher P/E ratio may indicate that investors anticipated higher earnings growth in the future.

However, no single ratio can tell you everything you need to know about a stock. Before making an investment, it is advisable to use a variety of financial ratios to assess a stock’s fair value and whether the company’s financial standing supports the stock price.

Investor Expectations

In general, companies with a high P/E indicate that investors anticipate greater future earnings growth than those with a low P/E. A low P/E can either mean that a company is currently undervalued or that it is performing remarkably well in comparison to its historical trends. The P/E will be written as N/A if a company has no earnings or is experiencing a loss. Although it is possible to calculate a negative P/E ratio, this is not the standard practice.

It is also possible to think of the price-to-earnings ratio as a way to uniformly value $1 of earnings across the entire stock market. Theoretically, one could create a standardized P/E ratio by averaging P/E ratios over a number of years. This benchmark P/E ratio could then be used to determine whether a stock is worth purchasing.

N/A Meaning

A P/E ratio of N/A indicates that the ratio is either unavailable or inappropriate for the stock of the company. If a company is newly listed on the stock market and hasn’t yet reported earnings, as in the case of an initial public offering (IPO), it may have a P/E ratio of N/A. However, it can also mean that a company has zero or negative earnings, and investors may therefore interpret N/A as a company reporting a net loss.

P/E vs. Earnings Yield

Earnings yield, also known as the E/P ratio, is the inverse of the P/E ratio. Thus, earnings yield is defined as EPS divided by stock price as a percentage.

If Stock A is currently worth $10 and its TTM EPS was 50 cents, then its P/E is 20 ($10 / 50 cents) and its earnings yield is 5% ($50 cents / $10). If Stock B is trading at $20 and its EPS (TTM) is $2, it has a P/E of 10 (i.e., $20 / $2) and an earnings yield of 10% = ($2 / $20).

Compared to the P/E ratio, the earnings yield is a less popular metric for valuing investments. If you are worried about the rate of return on your investment, earnings yields can be helpful. However, for equity investors, increasing the value of their investments over time may be more important than generating regular investment income. Due to this, when making stock investments, investors may favor value-based investment metrics like the P/E ratio over earnings yield.

When a company has no earnings or negative earnings, the earnings yield can still be useful in generating a metric. Due to the prevalence of this scenario in high-tech, fast-growing, or startup businesses, EPS will be negative and the resulting P/E ratio will be undefined (denoted as N/A). However, a company that experiences a loss will generate a negative earnings yield that can be interpreted and used as a benchmark.

P/E vs. PEG Ratio

Even a P/E ratio derived from a forward earnings estimate may not always indicate whether the P/E is suitable for the company’s anticipated growth rate. Investors therefore use the PEG ratio, another ratio, to overcome this limitation.

PEG, also known as the price/earnings-to-growth ratio, is a variant of the forward P/E ratio. The PEG ratio tells investors a more complete story than the P/E alone by measuring the relationship between price/earnings ratio and earnings growth. In other words, the PEG ratio enables investors to determine whether a stock’s price is overvalued or undervalued by examining both the company’s current earnings and its anticipated future growth rate. The PEG ratio is determined by dividing a company’s trailing price-to-earnings (P/E) ratio by the earnings growth rate over a given time period.

In comparison to the P/E ratio, the PEG ratio is used to calculate a stock’s value based on trailing earnings and also takes into account the company’s potential for future earnings growth. For instance, a low P/E ratio might imply that a stock is undervalued and should be purchased; however, the PEG ratio, which takes into account the company’s growth rate, may reveal a different picture. PEG ratios can be classified as “forward” or “trailing” depending on whether historical or projected growth rates are used.

Although earnings growth rates can vary among different sectors, a stock with a PEG of less than 1 is typically considered undervalued because its price is considered low compared to the company’s expected earnings growth. An overvalued stock may have a PEG greater than 1, which suggests that the stock price is too high in relation to the company’s anticipated earnings growth.

Relative vs. Absolute P/E

Analysts may also distinguish between absolute and relative P/E ratios in their analysis.

Absolute P/E

This ratio’s numerator is usually the current stock price, and the denominator can be trailing EPS (TTM), estimated EPS for the next 12 months (forward P/E), or a combination of trailing EPS from the previous two quarters and forward P/E from the next two quarters.

It’s crucial to keep in mind that absolute P/E refers to the P/E for the current time period when separating it from relative P/E. For instance, the P/E is 50 = ($100 / $2) if the stock price is $100 today and the TTM earnings are $2 per share.

Relative P/E

The relative P/E evaluates the present absolute P/E in relation to a standard or a range of prior P/Es over a pertinent time frame, such as the previous 10 years. The relative P/E indicates what proportion of the previous P/Es the current P/E has attained. Investors may compare the current P/E to the bottom side of the range to determine how close the current P/E is to the historical low. The relative P/E typically compares the current P/E value to the highest value of the range.

If the current P/E is less than the previous value (whether the previous high or low), the relative P/E will have a value below 100%. Investors are informed that the current P/E has matched or surpassed the previous value if the relative P/E measure is 100% or higher.

Limitations of Using the P/E Ratio

The price-to-earnings ratio has some limitations that investors should be aware of, just like any other fundamental designed to help investors decide whether or not a stock is worth buying. This is important to remember because investors are frequently led to believe that there is one single metric that will provide complete insight into an investment decision, which is almost never the case.

Calculating a company’s P/E can be difficult for unprofitable businesses that have no earnings or negative earnings per share. There are different perspectives on how to handle this. The majority simply claim that the P/E doesn’t exist (N/A or not available) or is not interpretable until a company becomes profitable for purposes of comparison. Some claim that there is a negative P/E, while others assign a P/E of 0.

Comparing the P/E ratios of various companies reveals one major drawback of using P/E ratios. Due to the various ways that companies generate revenue and the various time frames over which they do so, valuations and growth rates of companies can frequently differ drastically between industries.

As a result, P/E should only be used as a comparative tool when thinking about businesses in the same industry because only this kind of comparison will result in useful information. One might assume that one is clearly the superior investment based on a comparison of the P/E ratios of a telecommunications company and an energy company, for example, but this is not a sound conclusion.

Other P/E Considerations

Comparing a company’s P/E ratio to those of other businesses in the same industry gives it much more significance. For instance, a high P/E ratio may indicate that an energy company is part of a sector trend rather than a trend specific to that company. When the entire sector has high P/E ratios, for instance, a company’s high P/E ratio would be less concerning.

Leverage can also skew P/E ratios since a company’s debt can have an impact on both the share price and the company’s earnings. For instance, imagine two businesses that are similar except for the amount of debt they take on. The P/E value of the company with more debt will probably be lower than that of the company with less debt. However, the company with more debt may experience higher earnings if business is brisk as a result of the risks it has taken.

Price-to-earnings ratios have another significant drawback, and it’s related to the calculation method itself. The market value of the shares and accurate earnings per share estimates are necessary for accurate and objective presentations of P/E ratios. Through its ongoing bidding process, the market decides how much shares will cost. There are numerous reputable sources where you can find the printed prices. However, the company itself is ultimately the source for earnings data. Analysts and investors put their faith in the company’s officers to provide accurate information because this single source of data is more susceptible to manipulation. The stock will be viewed as riskier and consequently less valuable if that trust is perceived to have been broken.

The P/E ratio is just one of the metrics that analysts carefully examine to lower the likelihood of inaccurate information. If the company wanted to purposefully manipulate the numbers to look better and fool investors, they would have to put in a lot of effort to make sure that all metrics were changed in a logical way, which is challenging to do. As a result, the P/E ratio remains one of the most commonly used metrics when analyzing a company, but it is far from the only one.

What Is a Good P/E Ratio?

The answer to the question of whether a price-to-earnings ratio is good or bad will inevitably depend on the sector in which the company operates. The average price-to-earnings ratio will differ significantly across industries, with some having higher ratios than others. For instance, in January 2021, the average trailing P/E ratio for publicly traded broadcasting companies was only about 12, whereas it was over 60 for software companies. You can compare a P/E ratio to the average P/E of its competitors within its industry to get a general idea of whether it is high or low.

Is It Better to Have a Higher or Lower P/E Ratio?

As a result of paying less for each dollar of earnings, according to many investors, it is preferable to purchase shares of companies with a lower P/E ratio. In that sense, a lower P/E ratio is equivalent to a lower price tag, making it appealing to bargain-hunting investors. However, it’s crucial to know the causes of a company’s P/E in real life. The apparent bargain might only be a mirage, for instance, if a company has a low P/E because its business model is fundamentally failing.

What Does a P/E Ratio of 15 Mean?

Simply put, a P/E ratio of 15 indicates that the company’s current market value is equal to 15 times its yearly earnings. Literally, if you were to buy 100% of the company’s shares in a hypothetical transaction, it would take 15 years for the company’s ongoing profits to cover your initial investment, assuming the company never grows again.

Why Is the P/E Ratio Important?

Investors can use the P/E ratio to determine whether a company’s stock is overvalued or undervalued in relation to its earnings. The ratio serves as a gauge of what the market is prepared to pay for the company’s current operations as well as its potential for future growth. A high P/E ratio indicates that the market is confident in a company’s ability to grow and is willing to spend potentially excessive amounts of money now in order to capitalize on that potential.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram