Investing in real estate offers an attractive return on investment, especially over the long term. The pandemic had an impact on every industry, which caused the Indian GDP to shrink by 6.6% in 2020-21. In contrast to predictions, real estate showed remarkable resilience as an asset class by quickly recovering and currently experiencing a surge in demand.

Financial experts recommend investing between 10% and 15% of one’s gross income in order to ensure a prosperous retirement and achieve long-term financial goals. Many people are considering real estate investments as safe and long-term assets in these uncertain times characterized by stock market volatility. Such investments have numerous advantages, allowing investors to reap multiple benefits.

Most investment avenues are now vulnerable to the market’s invisible hand because of market volatility, an uncertain future, and banking failures, among many other factors. But, riding on a wave of housing demand, real estate has established itself as a bounce-back asset class, attracting massive investment from private equity and a variety of other sources.

Real estate investing has grown in popularity over time because it provides greater stability and higher returns than other asset classes. As a result of reforms such as the Real Estate (Regulation and Development) Act (RERA) and the Goods and Services Tax (GST), real estate investment has become more transparent and appealing.

Real estate is a tangible asset that possesses enduring worth. It presents investors with the opportunity to generate rental income or sell the property at a premium. Additionally, it can serve as collateral for securing financing, thereby making it a secure investment comparable to gold. The demand for housing has increased as the world’s population has surpassed 8 billion. The value of real estate is expected to appreciate in a country like India, where there is an unprecedented infrastructure boom and urbanization. Foreign Direct Investment reached a substantial $26.17 billion between April 2020 and December 2021. Notably, India has emerged as one of the top 10 housing markets worldwide in terms of price appreciation, mainly due to rapid urbanization and population growth.

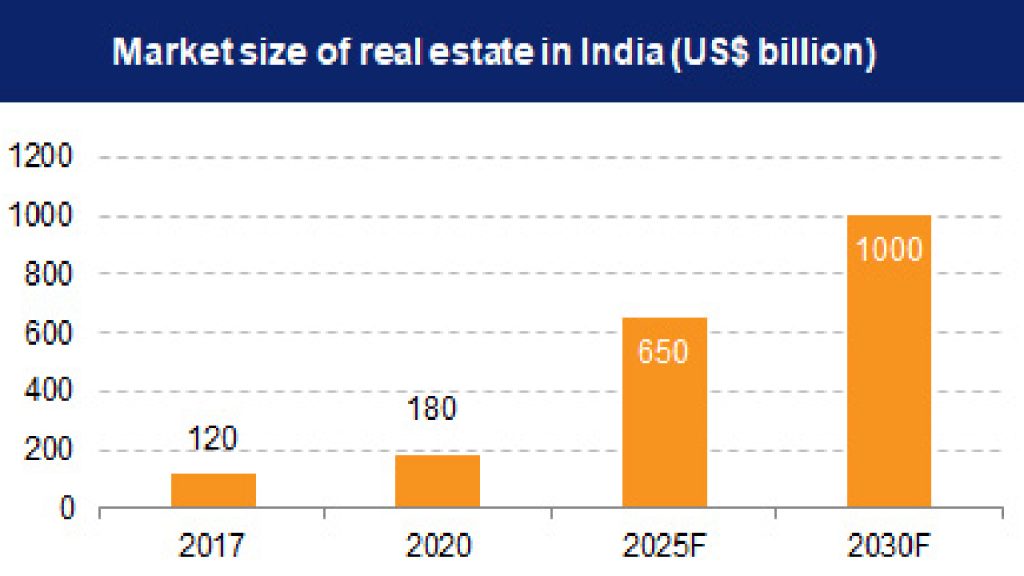

Market Size

The real estate market is predicted to increase from Rs. 12,000 crore (US$1.72 billion) in 2019 to Rs. 65,000 crore (US$9.30 billion) by 2040. In India, the real estate market is anticipated to grow to US$ 1 trillion in size by 2030 from US$ 200 billion in 2021 and to account for 13% of GDP by 2025. Retail, hospitality, and commercial real estate are all experiencing significant growth as well, which is crucial infrastructure for India’s expanding needs.

In the first nine months of FY22, the top eight cities in India’s real estate market saw land deals totaling more than 1,700 acres. From 2017 to 2021, there were 10.3 billion dollars in foreign investments in the commercial real estate market. Following the replacement of the current SEZs Act, developers anticipate a sharp increase in demand for office space in SEZs as of February 2022.

The influx of investors is accelerating the real estate growth trajectory to new heights. Investors are drawn to real estate because it can withstand the uncertainty of the stock market. Real estate offers a sense of security because of its tangible nature, which protects it from market instability. Real estate investing also has the added benefit of tax advantages, solidifying its place as one of the safest avenues for capital preservation and returns.

Market post-pandemic

The nationwide lockdown brought on by the pandemic in 2020 caused the real estate market to slow down. Real estate stood out, demonstrating its resilience and amazing capacity to recover while many economic sectors were hit hard. Real estate experienced exponential growth across tier 1, 2, and 3 cities despite the difficulties encountered, such as elevated construction costs and a significant 225 bps hike in the repo rate. ICRA reports predicted that Indian real estate firms would raise Rs. 3.5 trillion in 2022 through infrastructure and real estate investment trusts.

Post-pandemic, people eagerly rushed to purchase properties. The middle class and upper middle class made significant investments in real estate, boosting its value and supporting the sector, after having saved money during the pandemic. The sizeable private equity investment that India’s real estate has attracted is another factor that contributes to its stability and allure. A Colliers India report claims that during the first half of 2021, when the government was gradually removing the lockdown measures, the Indian real estate market saw a significant inflow of private equity investments totaling US$ 2.9 billion.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram