This regulatory body was established in accordance with the Real Estate (Regulation and Development) Act, 2016, which was passed to regulate and foster transparency in the Indian state of Tripura’s real estate market.

RERA Tripura’s primary objective is to safeguard homebuyers’ interests, guarantee real estate developers’ ethical behavior, and create a process for settling disputes between homebuyers and developers. RERA is in charge of registering real estate projects and agents, keeping an eye on ongoing projects, and making sure that developers abide by the laws and guidelines set forth by the Act.

Homebuyers can also use the authority’s platform to complain about developers for any wrongdoing, delays in project completion, or other problems relating to the acquisition of their properties. RERA is essential in fostering the growth of the real estate industry while defending the interests of homebuyers. It also contributes to a transparent and effective real estate market in the state.

Provisions under Tripura RERA

The following are some of the key provisions under Tripura RERA:

Registration of Real Estate Projects: Before selling or marketing their projects, developers or promoters in Tripura must register them with Tripura RERA. The registration procedure entails providing comprehensive project information, such as the land title, approvals, financial information, project timeline, and promoter information.

Registration of Real Estate Agents: Tripura RERA also requires that all real estate agents working in the state register with RERA. This is to ensure that they operate transparently and ethically and that they provide accurate information to buyers.

Homebuyers’ Protection: Tripura RERA is in charge of making sure that purchasers of real estate are protected from dishonest business practices. The act establishes a Real Estate Appellate Tribunal to hear appeals against the orders of Tripura RERA.

Disclosure and Transparency: According to RERA Tripura, developers must provide accurate and comprehensive information about their projects, including the current status of approvals, project schedules, and financial data. This is to prevent developers from deceiving buyers and allow them to make informed decisions.

Escrow Account: According to RERA Tripura, developers are required to put 70% of the money they receive from customers in a separate escrow account that can only be used for building and land expenses. This is to guarantee that the project is finished on schedule and that any money collected from buyers is not used for other endeavors.

Timely Project Delivery: RERA Tripura requires developers to complete their projects within the timeframe specified. In the event of a delay, the developer is required to compensate the buyer in accordance with the terms of the agreement.

RERA Tripura provides a mechanism for regulating and promoting the real estate sector in the state and ensures that the interests of homebuyers are protected.

Registration process with Tripura RERA

To get registered with RERA Tripura, you need to follow the below given steps:

- First, visit to official website of Tripura RERA at rera.tripura.gov.in and click on “Registration” tab

- Choose the type of registration you want to apply for – agent or developer.

- Fill in the registration form with your personal and business details, such as your name, Aadhaar card details, contact information, PAN card details, and business registration number.

- Upload the necessary documents, including a copy of your PAN card, Aadhaar card, business registration certificate, and any other relevant documents.

- Pay the registration fee in accordance with Tripura RERA regulations. The fee for agent registration is Rs. 5,000, and the fee for developer registration is determined by the project’s size and location.

- The Tripura RERA authority will issue you a registration number and certificate once your application is approved.

- You can check the status of your application online once it has been submitted.

It is important to note that all real estate agents and developers in Tripura are required to register under RERA. Non-compliance with the registration requirements can result in penalties and legal action.

Project registration process with RERA

The Act requires that all real estate projects with more than eight units or a land area of more than 500 square meters be registered with the state RERA authority before they are launched.

To register a real estate project under RERA in Tripura, you can follow these steps:

- Visit the official website of RERA rera.tripura.gov.in.

- Click on the “Registration” tab on the home page and select “Real Estate Project” from the drop-down menu.

- Complete the necessary fields on the online application form, including those for the project, the promoter, and the land.

- Upload all required paperwork, such as the project’s layout plan, land title records, and other approvals and certificates that are necessary.

- Pay the required registration fee online using the website’s payment gateway.

- Submit the application form along with the required papers and a receipt for your payment.

After receiving the application, the RERA authority will review the information and supporting documentation and, if everything is found to be in order, will grant registration. The registration certificate that RERA will issue will contain significant information about the project, such as the anticipated completion date, the promoter’s information, and other crucial specifics.

The RERA requires all projects to be registered, and failure to do so can result in severe fines and legal action. Therefore, it is crucial to follow the registration process precisely and to adhere to all requirements.

Filing a complaint under RERA

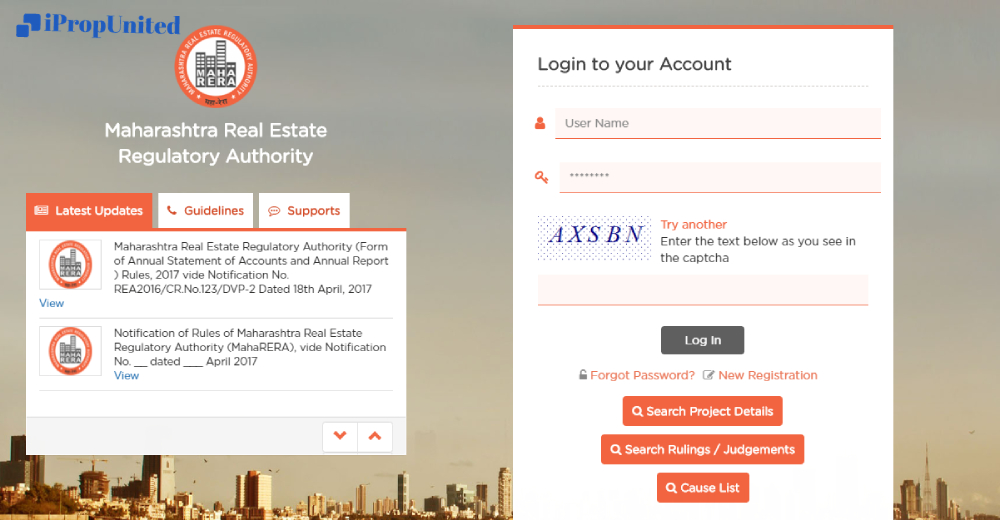

To file a complaint under the Real Estate (Regulation and Development) Act, 2016 (RERA) in Tripura, you can follow these steps:

- Visit the official website of RERA at rera.tripura.gov.in.

- Click on the “Complaint Registration” option on the homepage.

- You will be directed to a new page where you will have to select the appropriate option for your complaint type (such as allottee or promoter).

- Enter your personal details such as name, address, email, and contact number.

- Enter the details of the project against which you are filing the complaint, such as the name of the project, registration number, and the name of the promoter.

- Provide a brief description of the complaint and attach any supporting documents, if available.

- After providing all the required information, press the “Submit” button.

You will be given a complaint registration number that you can use to track the progress of your complaint and for future reference.

By going to the RERA office and bringing the required paperwork and a written complaint, you can also file a complaint offline. The RERA office in Tripura is located at the following address:

Real Estate Regulatory Authority, Tripura

Ground Floor, Aranya Bhavan

Gorkhabasti, Agartala

West Tripura – 799006

You can contact the RERA Tripura office at +91 381 241 4024 or send an email to [email protected] for any further assistance or clarification.

Follow and Connect with us: Twitter, Facebook, Linkedin, Instagram

Besides illuminating your house, lighting plays a vital role in impacting the moods of its occupants. Not just internally, lighting has an equally relevant effect on the outer components, such as verandas, gardens, balconies, etc. Following are a few tips that one should take into consideration while defining appropriate lighting provisions within the home:

Besides illuminating your house, lighting plays a vital role in impacting the moods of its occupants. Not just internally, lighting has an equally relevant effect on the outer components, such as verandas, gardens, balconies, etc. Following are a few tips that one should take into consideration while defining appropriate lighting provisions within the home: The purpose of the lighting must be clearly defined before defining the lighting elements. For example, direct light is prohibited in the work area, while bedrooms require soothing lights. As lighting plays a vital role in altering one’s mood, a function you want your lighting to serve needs to be defined first

The purpose of the lighting must be clearly defined before defining the lighting elements. For example, direct light is prohibited in the work area, while bedrooms require soothing lights. As lighting plays a vital role in altering one’s mood, a function you want your lighting to serve needs to be defined first To achieve a variety of functions, adequate lighting must be provided in areas like the living room and kitchen. A floor lamp nestled on a couch in a living room or counter lighting in a kitchen can add gleam to your house.

To achieve a variety of functions, adequate lighting must be provided in areas like the living room and kitchen. A floor lamp nestled on a couch in a living room or counter lighting in a kitchen can add gleam to your house. From a subtle dim to a bright light, recessed lights in homes play a vital role in defining the lighting of a house. Areas like the kitchen or any workroom require the right lighting options. Bedrooms should be illuminated in a soft and subtle way.

From a subtle dim to a bright light, recessed lights in homes play a vital role in defining the lighting of a house. Areas like the kitchen or any workroom require the right lighting options. Bedrooms should be illuminated in a soft and subtle way. Night lights help prevent children from getting scared at odd hours. Your collection of nappy-changing pictures to rocking infants to sleep, lights can highlight all this perfectly. Kids’ room lighting should always be pleasing to the eyes.

Night lights help prevent children from getting scared at odd hours. Your collection of nappy-changing pictures to rocking infants to sleep, lights can highlight all this perfectly. Kids’ room lighting should always be pleasing to the eyes. Buying a chandelier for home decor without giving due consideration to space available within the room, may put the entire arrangement into chaos. Varieties of Chandeliers are available within the market with different textures and vibrant colors. Choose one following the space in the room say the height of the chandelier shall not exceed the headroom below it.

Buying a chandelier for home decor without giving due consideration to space available within the room, may put the entire arrangement into chaos. Varieties of Chandeliers are available within the market with different textures and vibrant colors. Choose one following the space in the room say the height of the chandelier shall not exceed the headroom below it.